levered recapitalization under trade off theory

Question 3 – Levered Recapitalization under Trade-off Theory

You are the CFO of UBT Inc. and you are considering conducting a levered recapitalization. Specifically, you are planning on issuing a perpetual bond with a face value of $1,500 million and you will use all of the proceeds from this bond issuance to pay your existing shareholders a one-time dividend. You anticipate that the cost of debt associated with this transaction will be 4.1%.

You believe that increasing UBT’s leverage will benefit investors in two ways: First, the firm will be able toreap valuable tax shields. Second, you expect that managers will be more incentivized to reduce costs and close down unprofitable projects as a result of this transaction. Specifically, you anticipate that this expected agency benefit has a present value of $50 million. You do not anticipate any agency or distress costs as a result of this transaction.

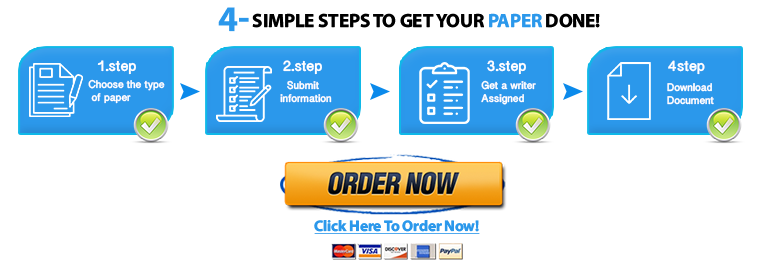

The table below shows additional information on UBT Inc. before the new bond is issued. You may assumethat the company has no excess cash, and that UBT’s investors do not pay personal taxes on interest,dividends, or capital gains.

- A) What is the enterprise value of UBT Inc. before the proposed transaction (i.e. before the new bond is issued)?

- B) What is the enterprise value of UBT Inc. after the dividend has been paid?

- C) What is the share price after the dividend has been paid?

Document attached.

Only need question 3 answered